FAFSA crucial for college applicants

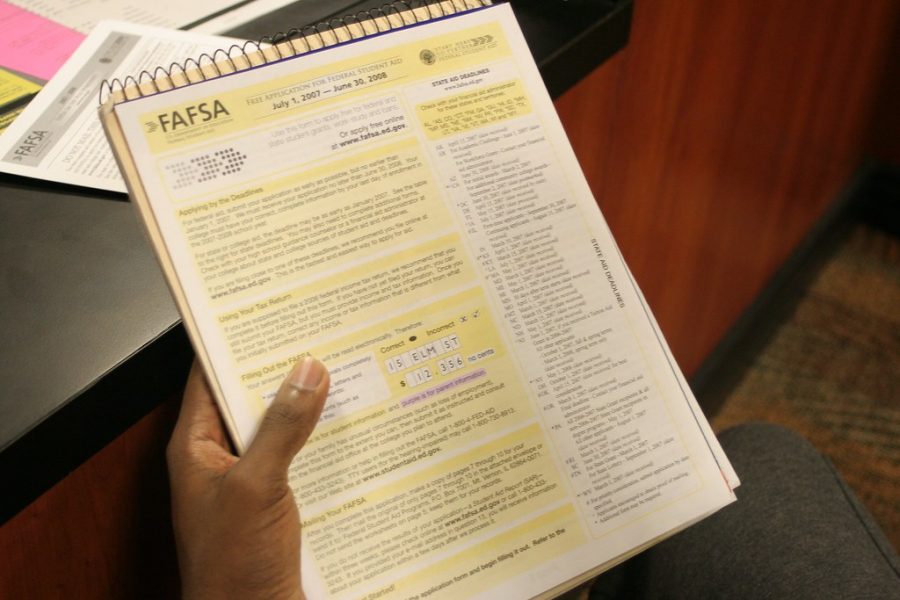

Students can request for a paper application to be sent to their home address if they are unfamiliar with the online platform.

For seniors facing many big decisions this year, there is one that lingers heaviest on the mind: How can I pay for college? Luckily, there are tools to help ease students’ financial strain.

The FAFSA, Free Application for Federal Student Aid, is a way to apply for grants, loans and most importantly, federal financial aid. Filling out a FAFSA application is one way for students to start securing their future.

Why Should I Apply?

After filling out a FAFSA application, one can review financial aid offers from the federal government and colleges of choice. How much financial aid one receives is based on family income.

“If your family’s income meets the qualifications for a federal pell grant, you can qualify for up to $6,600 of essentially free money to pay for college,” BRACE advisor Anna Hernandez said. “The lower your family income is the more free money you’re eligible for.”

The FAFSA can also be used to find ways to pay for things other than classes.

“You can also find out if you’re eligible for loans that can pay for tuition and other fees like room and board,” Hernandez said.

Before Applying:

Before even heading to the website, it would be a good idea to get papers and other necessities in order. First, determine if you are eligible. These eligibility rules are very general and apply to a majority of students. However, to apply you must be a U.S. citizen or eligible non-citizen. Also, any male applying must register with Selective Service to be eligible for federal funds.

To save time, one should gather the needed documents before starting the application. These documents include tax returns, social security number, driver’s license (if possible), un-taxed income records, and other information. These documents are needed to determine family income.

It is important to know which FAFSA to fill out before applying. For financial aid to cover summer classes, seniors should fill out the 2020-2021 application. This application requires 2018 tax returns. The 2021-2022 FAFSA covers school fees for the entire year of 2021 and summer of 2022.

To apply, it is required to create an FSA account. “You only need to make an FSA account once in your life. You can use the same one for the rest of your college career. Also, if your parents already have an account they can use the same one, but if not they also need to create one to fill out portions of the FAFSA,” Hernandez said.

It is also recommended to prepare a list of up to 10 colleges that will receive your FAFSA information.

How to Apply:

When you are ready to apply, head to the official FAFSA website.

Here, you can make an FSA account and begin by filling out the correct FAFSA application. For more details on eligibility or other concerns, this website goes in depth on the FAFSA process and how it works.

After Applying:

After submitting the application, your FSA account allows you to review your responses and make any necessary revisions. Mrs. Hernandez advised reviewing your SAR (Student Aid Report) to catch any mistakes.

Frequently check the status of your application. It should change from “Processing” to “Processed Successfully” after around a week; however, if you see “Missing Signatures” you only need to go back, revise, then send again.

It usually takes 3-5 days for an application to be processed. You will then receive a notification of completion via email, if provided.

While seniors may seem busy filling out a seemingly endless amount of forms like college applications, essays, or scholarships, the FAFSA is one form you don’t want to miss out on.

Applying for federal financial aid can help lift the burden of steep college tuition and make it easier to find loans and grants for other expenses.